Washington State Paycheck Calculator

Washington State, known for its stunning natural beauty and thriving tech industry, is home to a diverse range of professionals and businesses. When it comes to managing finances, understanding the intricacies of payroll calculations is crucial for both employers and employees. The Washington State paycheck calculator is a valuable tool designed to simplify the process of calculating take-home pay, considering various factors such as gross income, deductions, and taxes. In this article, we will delve into the specifics of how the Washington State paycheck calculator works, its importance, and the key factors that influence paycheck calculations in the state.

Understanding the Washington State Paycheck Calculator

The Washington State paycheck calculator is an online tool that helps individuals and businesses calculate the net pay of an employee based on their gross income and other relevant factors. This calculator takes into account federal income taxes, state income taxes (where applicable), and other deductions such as Social Security taxes and health insurance premiums. Washington State does not have a state income tax, which simplifies the calculation process compared to states with income tax. However, the absence of state income tax does not exempt residents from paying federal income taxes.

Key Factors Influencing Paycheck Calculations

Several factors play a crucial role in determining the take-home pay of an employee in Washington State. These include:

- Gross Income: The total amount of money earned by an employee before any deductions are made.

- Federal Income Taxes: These are taxes levied by the federal government on an individual’s income. The amount of federal income tax deducted depends on the employee’s tax filing status, number of allowances claimed, and the tax brackets set by the federal government.

- Social Security Taxes: Also known as payroll taxes, these are used to fund Social Security and Medicare. For the year 2023, the Social Security tax rate is 6.2% for employees, and the Medicare tax rate is 1.45% for employees.

- Health Insurance Premiums and Other Benefits: Deductions for health insurance, retirement plans, and other benefits can significantly impact an employee’s take-home pay.

| Category | Rate/Percentage |

|---|---|

| Federal Income Tax (single filer, 2023) | Varies by tax bracket (10% to 37%) |

| Social Security Tax | 6.2% of gross income (up to the annual limit) |

| Medicare Tax | 1.45% of gross income (no limit) |

Using the Washington State Paycheck Calculator

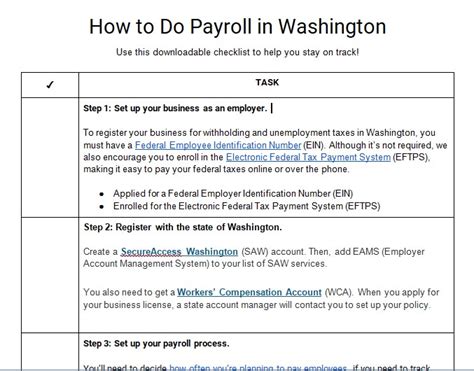

Utilizing the Washington State paycheck calculator involves inputting specific details about an employee’s income and deductions. The steps typically include:

- Entering the employee’s gross income per pay period.

- Selecting the pay frequency (e.g., biweekly, monthly).

- Inputting the number of allowances claimed on the employee’s W-4 form, which affects federal income tax withholding.

- Adding any additional deductions or contributions, such as health insurance premiums or 401(k) contributions.

- Submitting the information to generate an estimate of the employee’s take-home pay.

Key Points

- The Washington State paycheck calculator is a valuable tool for estimating take-home pay, considering federal taxes and other deductions.

- Understanding the factors that influence paycheck calculations, such as gross income, federal income taxes, and Social Security taxes, is essential for financial planning.

- Washington State's lack of state income tax simplifies paycheck calculations but does not eliminate the need for careful consideration of other deductions.

- Utilizing a paycheck calculator can help individuals and businesses ensure compliance with tax laws and plan their finances more effectively.

- Regular updates to tax rates and brackets mean that individuals should periodically review and adjust their withholdings and financial plans.

Importance of Accurate Paycheck Calculations

Accurate paycheck calculations are critical for maintaining employee satisfaction, ensuring compliance with tax laws, and managing business finances efficiently. Underestimating or overestimating taxes and deductions can lead to financial surprises at the end of the year, such as owing additional taxes or receiving an unexpected refund. Employers must also ensure that they are withholding the correct amount of taxes to avoid penalties from the IRS.

In conclusion, the Washington State paycheck calculator is an indispensable resource for navigating the complexities of payroll calculations in the state. By understanding how to use this tool and the factors that influence paycheck calculations, individuals and businesses can better manage their financial obligations and plan for the future.

How does the lack of state income tax in Washington affect paycheck calculations?

+The absence of state income tax in Washington simplifies paycheck calculations since it eliminates the need to account for state tax withholdings. However, federal income taxes, Social Security taxes, and other deductions still apply.

What information do I need to use the Washington State paycheck calculator?

+To use the calculator, you typically need to know the employee’s gross income, pay frequency, number of allowances claimed, and any additional deductions or contributions.

How often should I review and adjust my withholdings and financial plans?

+It’s a good practice to review and adjust your withholdings and financial plans periodically, especially after significant life changes or updates to tax laws and rates.