Utah Paycheck Calculator

Utah, known for its natural beauty and thriving economy, attracts individuals and businesses alike. For those living and working in Utah, understanding the state's taxation system is crucial for managing finances effectively. One of the key tools for navigating Utah's tax landscape is the Utah paycheck calculator. This tool is designed to help employees estimate their take-home pay, considering various factors such as gross income, deductions, and state-specific tax rates.

Understanding Utah Income Tax

Utah imposes a state income tax, which is a flat rate of 4.95% on taxable income. This rate applies to all taxpayers, regardless of their income level. While the state income tax rate is straightforward, the overall tax burden can vary based on federal income tax brackets, deductions, and credits. The Utah paycheck calculator takes these factors into account to provide a more accurate estimation of net pay.

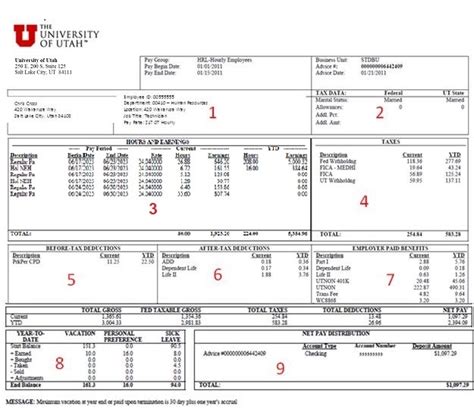

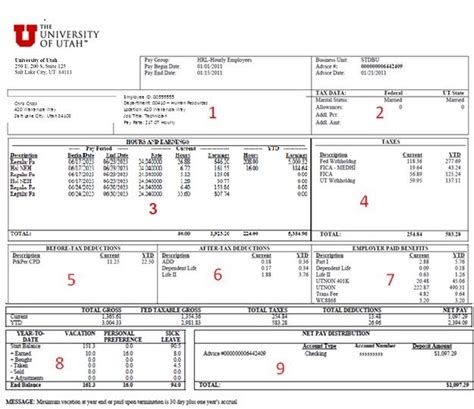

Components of the Utah Paycheck Calculator

A comprehensive Utah paycheck calculator considers several components to calculate an individual’s net pay:

- Gross Income: The total amount of money earned before any deductions or taxes are applied.

- Federal Income Tax: Based on the federal income tax brackets and the individual’s filing status, this is the amount withheld for federal taxes.

- State Income Tax: The 4.95% flat rate applied to taxable income for Utah state taxes.

- Deductions: Pre-tax deductions such as 401(k) contributions, health insurance premiums, and other benefits that reduce taxable income.

- Credits: Tax credits, both federal and state, that directly reduce the amount of tax owed.

| Income Level | Federal Tax Rate | Utah State Tax Rate |

|---|---|---|

| Low-Income | 10%-12% | 4.95% |

| Middle-Income | 22%-24% | 4.95% |

| High-Income | 32%-37% | 4.95% |

Using the Utah Paycheck Calculator for Financial Planning

Beyond estimating net pay, the Utah paycheck calculator can be a valuable tool for financial planning. By adjusting inputs such as income, deductions, and credits, individuals can see how different scenarios affect their take-home pay. This can be particularly useful for planning major life events, such as buying a home, having children, or retiring, where understanding the impact on finances is crucial.

Impact of Tax Changes on Utah Residents

Tax laws and regulations are subject to change, and these changes can significantly impact the finances of Utah residents. For instance, changes in federal tax brackets or the introduction of new state tax credits can alter the amount of taxes owed. Staying informed about these changes and using tools like the Utah paycheck calculator can help individuals adapt their financial plans accordingly.

Key Points

- The Utah paycheck calculator is a useful tool for estimating net pay, taking into account federal and state taxes, deductions, and credits.

- Utah imposes a flat state income tax rate of 4.95% on taxable income.

- Understanding and accurately inputting all forms of income, deductions, and credits is crucial for precise calculations.

- The calculator can aid in financial planning by allowing users to explore different scenarios and their financial implications.

- Staying updated on tax law changes is important for adjusting financial plans and maximizing benefits.

In conclusion, the Utah paycheck calculator is an indispensable resource for anyone looking to manage their finances effectively in the state of Utah. By providing a clear and accurate estimate of take-home pay and allowing for the exploration of different financial scenarios, this tool empowers individuals to make informed decisions about their financial futures.

How does the Utah paycheck calculator account for federal income taxes?

+The calculator considers federal income tax brackets and the individual’s filing status to estimate the federal income tax withholding.

Can I use the Utah paycheck calculator to plan for retirement?

+Yes, by adjusting income and deduction inputs to reflect retirement scenarios, individuals can estimate how retirement income and potential deductions might affect their net income.

How often should I review and update my inputs in the Utah paycheck calculator?

+It’s recommended to review and update inputs whenever there’s a significant change in income, deductions, credits, or tax laws to ensure the calculations remain accurate and relevant.