Paycheck Calculator New Jersey

New Jersey, known for its stunning coastline, vibrant cities, and thriving economy, is home to a diverse range of industries and professions. When it comes to managing finances, having the right tools at your disposal can make all the difference. A paycheck calculator, specifically designed for New Jersey, is an indispensable resource for both employees and employers looking to navigate the complexities of payroll and taxation. In this comprehensive guide, we will delve into the world of paycheck calculation in New Jersey, exploring the factors that influence take-home pay, the role of taxes, and how to use a paycheck calculator effectively.

Understanding New Jersey Paycheck Calculation

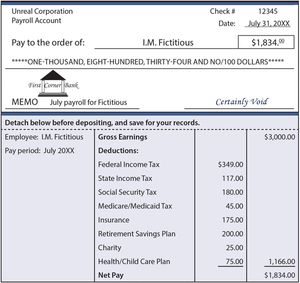

Calculating a paycheck in New Jersey involves considering several key factors, including gross income, federal and state income taxes, Social Security taxes, Medicare taxes, and any deductions for health insurance, 401(k), or other benefits. New Jersey has a progressive income tax system, with rates ranging from 5.525% to 10.75%, depending on income level. Additionally, the state imposes a tax on certain types of income, such as capital gains and dividends. To accurately calculate a paycheck, it’s essential to understand how these taxes impact take-home pay.

New Jersey Income Tax Brackets

For the tax year 2022, New Jersey has the following income tax brackets: 5.525% on the first 20,000 of taxable income, 6.37% on taxable income between 20,001 and 50,000, 7.95% on taxable income between 50,001 and 75,000, 8.97% on taxable income between 75,001 and 500,000, and 10.75% on taxable income over 500,000. These rates apply to both single and joint filers, although the income ranges may vary. Understanding these brackets is crucial for accurate paycheck calculation.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $20,000 | 5.525% |

| $20,001 - $50,000 | 6.37% |

| $50,001 - $75,000 | 7.95% |

| $75,001 - $500,000 | 8.97% |

| Above $500,000 | 10.75% |

How to Use a Paycheck Calculator in New Jersey

Utilizing a paycheck calculator specifically designed for New Jersey can streamline the process of managing payroll and understanding the impact of taxes on income. Here are the steps to follow: 1. Determine your gross income, which is your income before taxes and deductions. 2. Choose your filing status, such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). 3. Input the number of dependents you claim, as this affects your taxable income. 4. Consider any additional income, such as bonuses or income from a second job. 5. Account for deductions, including health insurance premiums, 401(k) contributions, and any other pre-tax deductions. 6. Use the calculator to compute your net pay, which is your take-home pay after all taxes and deductions have been subtracted.

Key Points

- Understand New Jersey's progressive income tax system to accurately calculate take-home pay.

- Input accurate information into a paycheck calculator, including gross income, filing status, and deductions.

- Consider the impact of federal and state taxes, as well as Social Security and Medicare taxes, on net pay.

- Regularly review and adjust paycheck calculations to reflect changes in income, deductions, or tax laws.

- Utilize a paycheck calculator as a tool to plan finances, budget, and make informed decisions about income and expenses.

Additional Considerations for New Jersey Paycheck Calculation

Beyond the basic factors, there are several additional considerations when calculating paychecks in New Jersey. These include understanding how different types of income are taxed, such as capital gains or self-employment income, and being aware of any tax credits or deductions that may apply, such as the Earned Income Tax Credit (EITC) or deductions for student loan interest. Additionally, changes in tax laws or regulations can impact paycheck calculations, making it essential to stay informed and adjust calculations accordingly.

For instance, the Tax Cuts and Jobs Act (TCJA) introduced in 2017 brought about significant changes to federal tax law, including adjustments to tax brackets and the standard deduction. Understanding these changes and how they apply to New Jersey residents is crucial for accurate paycheck calculation.

FAQs on Paycheck Calculators in New Jersey

How do I calculate my take-home pay in New Jersey?

+To calculate your take-home pay in New Jersey, you need to consider your gross income, federal and state income taxes, Social Security taxes, Medicare taxes, and any deductions. Using a paycheck calculator can simplify this process and provide an accurate estimate of your net pay.

What is the impact of New Jersey’s progressive income tax system on my paycheck?

+New Jersey’s progressive income tax system means that different levels of income are taxed at different rates. As your income increases, the tax rate on the higher amounts of income also increases. This can impact your take-home pay, as a larger portion of your income may be subject to higher tax rates.

Can I use a paycheck calculator to plan my finances and budget?

+Yes, a paycheck calculator can be a valuable tool in planning your finances and budget. By understanding your take-home pay and how different factors such as income, taxes, and deductions impact it, you can make informed decisions about spending, saving, and investing.

Meta Description: Discover how to accurately calculate your paycheck in New Jersey, considering factors like income tax brackets, deductions, and state-specific laws. Learn to use a paycheck calculator for precise estimates and informed financial planning.

In conclusion, navigating the complexities of paycheck calculation in New Jersey requires a deep understanding of the state’s tax system, the factors that influence take-home pay, and the effective use of a paycheck calculator. By following the guidelines and insights provided in this article, individuals and employers can better manage their finances, plan for the future, and make the most of their income in the Garden State.