Lift Insraunce Vs. Health Insurance

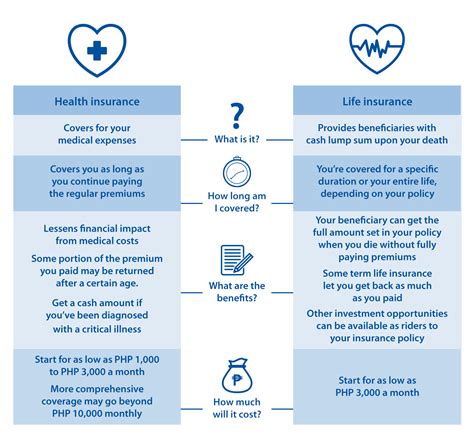

When it comes to securing financial protection against unforeseen medical expenses, two types of insurance policies often come to mind: Lift Insurance and Health Insurance. While both types of insurance provide a safety net against medical emergencies, they differ significantly in terms of their coverage, benefits, and purpose. In this article, we will delve into the world of Lift Insurance and Health Insurance, exploring their definitions, differences, and benefits, to help you make an informed decision about which type of insurance is right for you.

Key Points

- Lift Insurance and Health Insurance are two distinct types of insurance policies that provide financial protection against medical expenses.

- Lift Insurance typically covers expenses related to funeral services, burials, and other final expenses, whereas Health Insurance covers medical expenses incurred during hospitalization, surgery, or other medical treatments.

- The primary purpose of Lift Insurance is to alleviate the financial burden on loved ones in the event of the policyholder's passing, while Health Insurance aims to provide financial protection against medical expenses incurred during the policyholder's lifetime.

- Lift Insurance policies often have a lower premium compared to Health Insurance policies, but the coverage and benefits are also limited.

- Health Insurance policies, on the other hand, offer more comprehensive coverage, including doctor visits, hospital stays, and prescription medications, but often come with higher premiums and deductibles.

Understanding Lift Insurance

Lift Insurance, also known as final expense insurance or burial insurance, is a type of life insurance policy that provides a lump sum payment to the policyholder’s beneficiaries in the event of their passing. The primary purpose of Lift Insurance is to cover expenses related to funeral services, burials, and other final expenses, alleviating the financial burden on loved ones. Lift Insurance policies typically have a lower premium compared to Health Insurance policies, but the coverage and benefits are also limited.

Benefits of Lift Insurance

The benefits of Lift Insurance include:

- Financial protection for loved ones in the event of the policyholder’s passing

- Coverage for funeral expenses, burials, and other final expenses

- Lower premiums compared to Health Insurance policies

- Simplified underwriting process, with some policies not requiring a medical exam

Understanding Health Insurance

Health Insurance, on the other hand, is a type of insurance policy that provides financial protection against medical expenses incurred during hospitalization, surgery, or other medical treatments. Health Insurance policies offer more comprehensive coverage, including doctor visits, hospital stays, and prescription medications. The primary purpose of Health Insurance is to provide financial protection against medical expenses incurred during the policyholder’s lifetime.

Benefits of Health Insurance

The benefits of Health Insurance include:

- Comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications

- Financial protection against unexpected medical expenses

- Access to a network of healthcare providers and medical facilities

- Preventive care services, such as routine check-ups and screenings

| Insurance Type | Coverage | Premium |

|---|---|---|

| Lift Insurance | Funeral expenses, burials, and other final expenses | Lower premium |

| Health Insurance | Medical expenses, doctor visits, hospital stays, and prescription medications | Higher premium |

Comparison of Lift Insurance and Health Insurance

When comparing Lift Insurance and Health Insurance, it’s essential to consider the coverage, benefits, and premiums of each policy. Lift Insurance policies typically have a lower premium compared to Health Insurance policies, but the coverage and benefits are also limited. Health Insurance policies, on the other hand, offer more comprehensive coverage, including doctor visits, hospital stays, and prescription medications, but often come with higher premiums and deductibles.

Key Differences

The key differences between Lift Insurance and Health Insurance include:

- Coverage: Lift Insurance covers expenses related to funeral services, burials, and other final expenses, while Health Insurance covers medical expenses incurred during hospitalization, surgery, or other medical treatments.

- Premium: Lift Insurance policies typically have a lower premium compared to Health Insurance policies.

- Benefits: Lift Insurance provides financial protection for loved ones in the event of the policyholder’s passing, while Health Insurance offers comprehensive coverage for medical expenses incurred during the policyholder’s lifetime.

What is the primary purpose of Lift Insurance?

+The primary purpose of Lift Insurance is to alleviate the financial burden on loved ones in the event of the policyholder's passing by covering expenses related to funeral services, burials, and other final expenses.

What is the primary purpose of Health Insurance?

+The primary purpose of Health Insurance is to provide financial protection against medical expenses incurred during the policyholder's lifetime, including doctor visits, hospital stays, and prescription medications.

Which type of insurance policy is right for me?

+The type of insurance policy that is right for you depends on your individual needs and circumstances. If you are looking for financial protection for loved ones in the event of your passing, Lift Insurance may be a good option. If you are looking for comprehensive coverage for medical expenses, Health Insurance may be a better choice.

Meta Description: Learn about the differences between Lift Insurance and Health Insurance, including coverage, benefits, and premiums. Understand which type of insurance policy is right for you and make an informed decision about your insurance needs. (147 characters)