Broker Of Health And Life Insurance

As a broker of health and life insurance, it's essential to understand the complexities of the insurance industry and the various options available to clients. With years of experience in the field, I've developed a comprehensive knowledge of the different types of insurance policies, including individual and group health insurance, life insurance, disability insurance, and long-term care insurance. My expertise in navigating the intricacies of insurance plans has enabled me to provide personalized guidance to clients, helping them make informed decisions about their insurance needs.

One of the primary challenges facing individuals and families is selecting the right health insurance plan. With the Affordable Care Act (ACA) in place, there are various options available, including marketplace plans, Medicare, and Medicaid. As a broker, I've worked with numerous clients to determine their eligibility for these programs and to explore other alternatives, such as short-term health insurance and health sharing ministries. My knowledge of the ACA's metal tiers, including Bronze, Silver, Gold, and Platinum, has allowed me to advise clients on the most suitable plan for their budget and healthcare requirements.

Key Points

- Understanding the different types of health insurance plans, including individual and group plans, is crucial for making informed decisions.

- Knowledge of the Affordable Care Act (ACA) and its metal tiers can help clients choose the most suitable plan for their budget and healthcare needs.

- Life insurance policies, including term life and whole life, can provide financial protection for loved ones in the event of unexpected death.

- Disability insurance and long-term care insurance can help individuals prepare for unexpected events, such as illness or injury, that may impact their ability to work or require ongoing care.

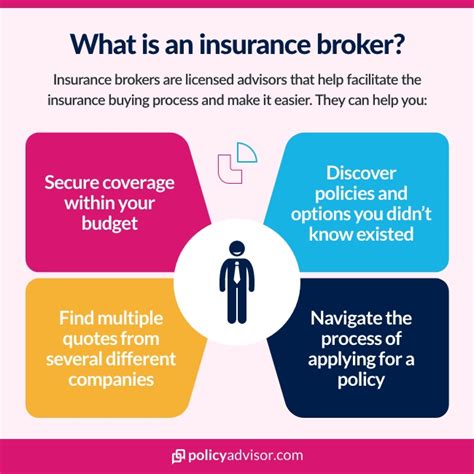

- Working with a licensed insurance broker can provide clients with personalized guidance and support in navigating the complexities of the insurance industry.

Life Insurance Options

Life insurance is an essential component of a comprehensive financial plan, providing financial protection for loved ones in the event of unexpected death. There are two primary types of life insurance: term life and whole life. Term life insurance provides coverage for a specified period, usually 10, 20, or 30 years, and is often less expensive than whole life insurance. Whole life insurance, on the other hand, offers lifetime coverage and a cash value component that can be borrowed against or used to pay premiums. As a broker, I’ve helped clients determine the most suitable type and amount of life insurance coverage based on their individual circumstances and financial goals.

Disability Insurance and Long-Term Care Insurance

Disability insurance and long-term care insurance are two often-overlooked components of a comprehensive insurance plan. Disability insurance provides financial protection in the event of illness or injury that prevents an individual from working, while long-term care insurance helps cover the costs of ongoing care, such as nursing home or home health care. As a broker, I’ve worked with clients to assess their needs for these types of insurance and to explore available options, including individual and group plans.

| Type of Insurance | Description | Benefits |

|---|---|---|

| Term Life Insurance | Provides coverage for a specified period | Affordable, flexible, and convertible to whole life |

| Whole Life Insurance | Offers lifetime coverage and a cash value component | Guaranteed death benefit, cash value accumulation, and tax-deferred growth |

| Disability Insurance | Provides financial protection in the event of illness or injury | Replacement of income, protection of assets, and maintenance of lifestyle |

| Long-Term Care Insurance | Covers the costs of ongoing care, such as nursing home or home health care | Protection of assets, maintenance of lifestyle, and access to quality care |

Industry Trends and Developments

The insurance industry is constantly evolving, with new products and services emerging to meet the changing needs of clients. As a broker, I’ve seen a shift towards more personalized and flexible insurance plans, including customized policies and rider options. The rise of digital platforms and online marketplaces has also increased accessibility and transparency in the insurance industry, allowing clients to compare plans and prices more easily. However, this increased accessibility also presents challenges, such as the potential for misinformation and the importance of working with a licensed and experienced broker.

Challenges and Opportunities

Despite the many benefits of working with a licensed insurance broker, there are challenges and opportunities that must be addressed. One of the primary challenges is the complexity of the insurance industry, which can make it difficult for clients to navigate and understand their options. As a broker, I’ve developed strategies to overcome this challenge, including providing clear and concise explanations of insurance concepts and offering personalized guidance and support. Another opportunity is the growing demand for specialized insurance products, such as cyber insurance and cannabis insurance, which require a deep understanding of the underlying risks and exposures.

What is the difference between a broker and an agent in the insurance industry?

+A broker typically represents the client and works with multiple insurance carriers to find the best policy, while an agent represents the insurance carrier and may only offer policies from that carrier.

How do I determine the right amount of life insurance coverage for my family?

+The right amount of life insurance coverage depends on various factors, including income, expenses, debts, and financial goals. A licensed insurance broker can help you assess your needs and determine the most suitable amount of coverage.

What is the difference between short-term and long-term disability insurance?

+Short-term disability insurance provides benefits for a limited period, usually up to 2 years, while long-term disability insurance provides benefits for an extended period, often until age 65 or retirement.

In conclusion, as a broker of health and life insurance, I’ve developed a deep understanding of the complexities of the insurance industry and the various options available to clients. By staying up-to-date on the latest developments and trends, I can provide clients with personalized guidance and support, helping them navigate the intricacies of insurance plans and make informed decisions about their insurance needs. Whether it’s individual or group health insurance, life insurance, disability insurance, or long-term care insurance, I’m committed to helping clients find the most suitable coverage for their unique circumstances and financial goals.